Many of us dream of leaving behind a legacy of wealth that our heirs can enjoy. A very noble dream indeed. But what if I said that wasn’t enough? What if I said, there is no amount of money that you could leave behind to secure the financial future of your heirs on a sustainable level?

Ok. Let’s take a breath for a minute… Before you think you are off track, just know that securing the financial future of your heirs will take money. But that is only part of it.

Read on!

Generational wealth, as defined by Megan DeMatteo, refers to “any kind of asset that families pass down to their children or grandchildren, whether in the form of cash, investment funds, stocks and bonds, properties or even entire companies.”

Although this is a great definition, it is too cut and dry for this post. My idea of generational wealth is actually “multi-generational” – your children, their children, their children’s children, and so on. I envision a more sustainable legacy, one that requires more than just leaving behind a large pile of cash.

So let’s run with this idea of “multi-generational wealth”, and use a multifaceted approach. One that discusses both financial means as well as financial intelligence.

You can’t have one without the other.

Without financial intelligence, millions of dollars can be mismanaged and gone in a heartbeat. On the other hand, a financially literate person with insufficient means will find great struggle in achieving financial freedom for themselves, let alone their heirs.

So let’s strike a healthy balance between the two and highlight some steps you can follow.

Step one – You first. Calculate your financial freedom number.

In other words, how much money do you need to be earning passively today, to comfortably quit your day job? Everybody will have a different target number. Multifamily real estate guru, author, and coach, Bill Ham of Broadwell Property Group helped me clarify this process.

For simplicity’s sake, we will focus on basic numbers using a financial freedom number that I hear often $10k a month. To achieve this goal, you will need to have $1.5M invested in a cash-flowing asset, earning 8% yearly returns. At the time of this post, this is a common “preferred return” offered to passive investors in a typical multifamily syndication deal. This will be your first milestone; getting enough cash or equity that will produce the $10k per month in passive income.

Step two – Calculate the financial freedom number of your heirs

This target will be a bit trickier to establish as you don’t yet know their expenses. You can make yourself crazy trying to get too precise. There are a ton of variants, such as inflation, the number of children you have, the number of children they (will) have, cost of living by geographic location, interests, business interests, etc. The list can go on forever.

Don’t get overwhelmed here. As a general rule, we can quote the great Warren Buffet regarding how much to leave our heirs – ”enough money so that they would feel they could do anything, but not so much that they could do nothing.” Read that article here.

In other words, take care of your family financially but make sure they remain curious and driven as well.

Once you have a ballpark number you’d like your heirs to inherit, you can use the same method stated above. Figure out how much money you’d need to have invested.

The easiest way to think about it is just to use your financial freedom number and multiply it by the number of people you’d like to inherit your estate.

Step three – Execute the plan

This part will be up to you to decide how to accomplish. I can offer my guidance in the real estate industry, and I’d be happy to help. I offer a ton of free education through my weekly podcast, monthly meetup, and consultation calls. Reach out here.

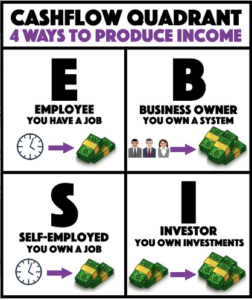

You don’t have to invest in real estate, however. Robert Kiyosaki, author of Rich Dad Poor Dad and the Cashflow Quadrant discusses the 4 ways to earn money –

I love the simplicity of this graphic, and if you don’t understand this chart yet, I recommend reading the book. It took me years to truly comprehend this model, but I now focus my attention on producing income in the “business owner” and “investor” quadrants.

As a real estate investor, it is extremely valuable to be able to own investments (cash-flowing assets) that you can leave to your heirs. These can provide cash flow for your retirement and can be passed down to your heirs.

Want to keep it simple? – leave behind 1 building per child that will earn x amount of cash-flow per month.

Step four – Financial intelligence: always seek to improve this area of your life.

You, being a healthy parent and role model will need to impart exceptional financial intelligence unto your heirs.

Here’s why they will need it – Physical assets, like apartment buildings, don’t last forever. Different stages of an asset’s lifespan will require different strategies in order to maintain a certain level of cash flow, and the business plan will change. So regardless of whether or not you leave your children financially free with some great, cash-flowing apartment buildings, they will need education, financial literacy, the mindset, and the drive to continue the cycle you’ve set forth.

Tips to increase the chances of your heirs continuing the cycle of multigenerational wealth –

- Constantly work on yourself – your personal development, your financial goals, financial intelligence.

- Keep up to date with what is going on in the market, the world, constantly network, understand micro/macroeconomics, etc.

- Model. There is no better way to teach our children financial freedom and financial literacy than to model best practices. Our children will copy what we do.

- Apprenticeship. Have your children join you on a deal as a partner. Let them learn the business alongside you. Begin connecting them with your trusted network at an early age. Have them asset manage a property or multiple properties. Teach them leadership skills, and how to be business savvy.

- Anticipate unpredictables. Circumstances will arise that you cannot foresee in the future, and you must teach your kids about adversity and being adaptable. Teach and model how to seek help and guidance when necessary. And perhaps most of all; teach them the burning desire to succeed.

- Share the love of being a lifelong learner and teach them the importance of passing on these traits and skills to their children.

Now that you understand the basics of creating and sustaining generational wealth it’s time to implement your plan and continue to revisit, reflect, and redesign as necessary. This is obviously a ton of work that requires consistent action, focus, and commitment. So I recommend connecting with people on the same path as you and go at it together!

In summary, we should all be seeking “multi-generational wealth” instead of generational wealth. This means we will have to leave behind more than just financial means, but financial intelligence as well. I feel it is the best and safest way to leave a lasting legacy.

Remember the old proverb –

Give a man a fish, and he will eat for a day. Teach a man to fish and he will eat for a lifetime.

One love,

Nico